Table of Contents

Introduction – Blue Sky Breakout Strategy

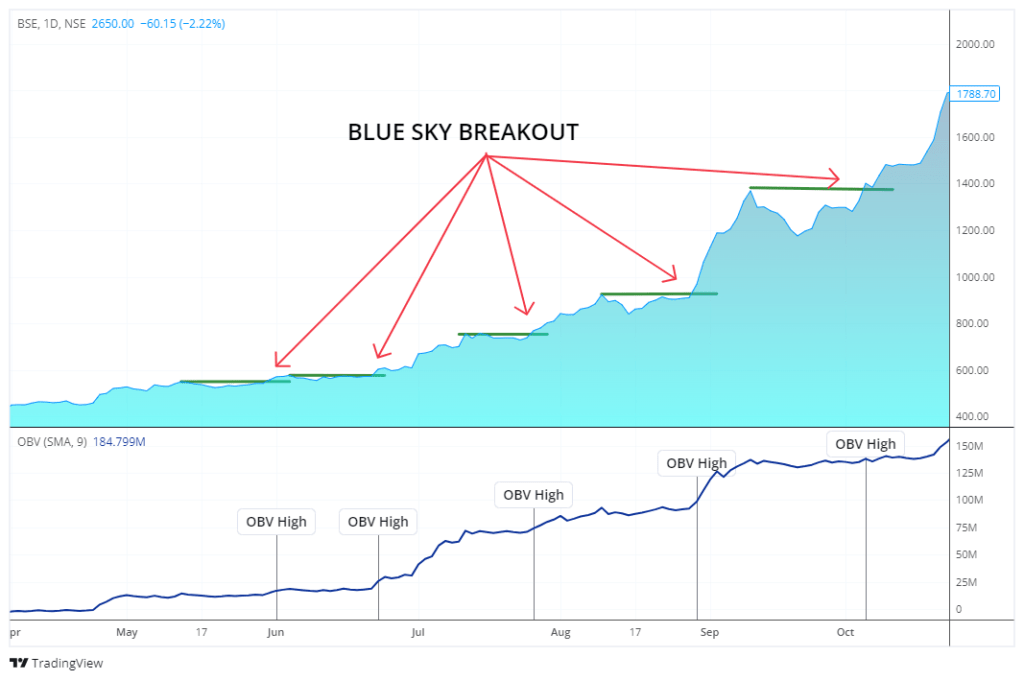

“Blue Sky Breakout Strategy” – In the vast ocean of stock market strategies, seasoned traders navigate through waves of volatility, searching for that elusive gem – the perfect setup. But what happens when the market seems to defy gravity, soaring higher and higher without a hint of retreat? It’s during these times of relentless bullish momentum that trend traders unleash their secret weapon: the Blue Sky Breakout Strategy.

Imagine yourself on a clear summer day, gazing up at the boundless expanse of the sky. Just as the sky knows no limits, the Blue Sky Breakout Strategy defies conventional boundaries in the stock market. This setup, akin to a cup-and-handle formation, emerges as a beacon of opportunity amidst a strongly trending market.

Suppose, you’re at the beach, observing the ebb and flow of the tides. Similarly, in the stock market, the Blue Sky Breakout Strategy thrives in bullish conditions, where there’s a continuous surge in prices without significant pullbacks. While swing traders may find themselves sidelined, waiting for the tide to turn, trend traders seize the moment, capitalizing on the relentless upward momentum.

Now, let’s delve into the characteristics of this powerful setup:

Market Type:

The Blue Sky Breakout Strategy flourishes in strongly trending markets, where bulls reign supreme and pullbacks are a rare sight. It’s like catching a wave in surfing – timing is everything, and you want to ride the momentum to new heights.

Key Indicators:

To spot a Blue Sky Breakout, we rely on a combination of price parameters and one key technical indicator: On Balance Volume (OBV). Think of OBV as your trusty compass, guiding you through the turbulent waters of market sentiment.

Understanding OBV:

Now, let’s demystify the role of On Balance Volume (OBV). OBV measures the accumulation or distribution of shares, signaling strength when it rises with price and divergence when it moves against it. Like a weather vane, OBV tends to lead rather than lag, providing valuable insights into future price movements.

The Rules of Engagement:

To identify a Blue Sky Breakout, we adhere to a set of rules that act as our navigation chart:

- New Highs: The stock’s closing price must register a new high following a previous pivot high set within the past minimum 5 to maximum 20 trading days. It’s like climbing a mountain – each new high signifies reaching a higher peak.

- Significance: The new closing price high must be significant, with no higher closing price recorded in at least the past three months. We’re looking for a breakthrough, not just a mere blip on the radar.

- Avoiding Overextension: The new closing price high should not be too far (not more than 300%) above the 52-week low for the stock. We want to avoid stocks that are overextended, like stretching a rubber band to its breaking point.

- Confirmation: The breakout into blue sky territory should be accompanied by the highest OBV reading seen in at least the past three months. It’s like the swell of the ocean, confirming the strength of the current.

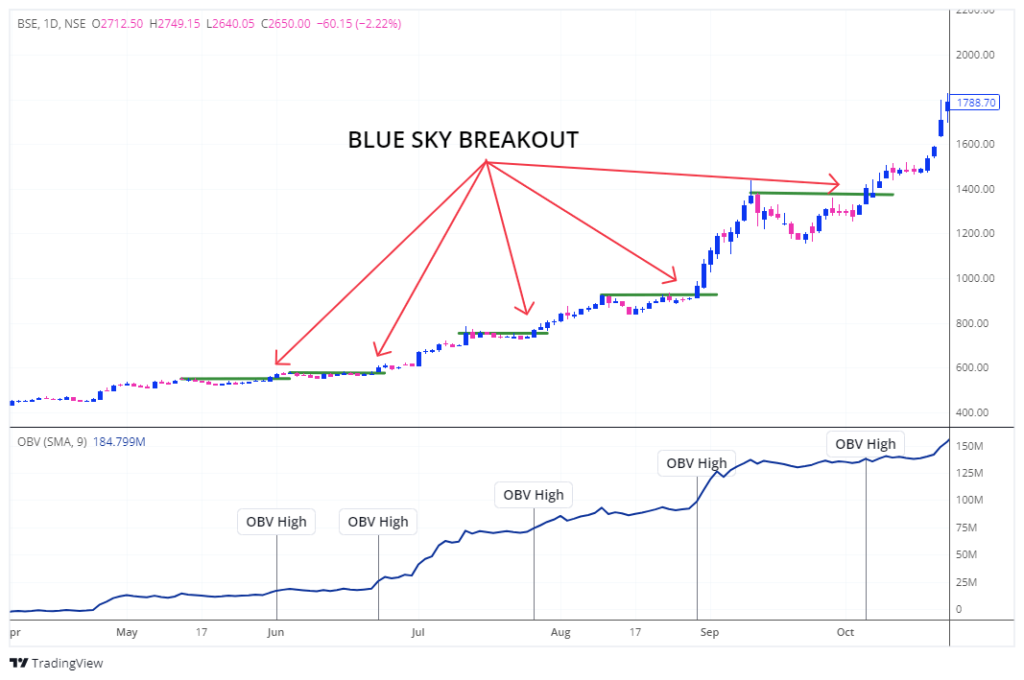

- Candlestick Confirmation: The candle on the day of the breakout must be green or white (Close greater than Open), indicating bullish momentum. It’s like a beacon of light guiding us towards potential profits.

Buy Signal:

When all five parameters align on the same day, we have a clear buy signal. It’s like finding treasure at the end of a long journey – a reward for patience and precision.

Strategy is Based On the Closing Price, So Always refer to the Closing Price.

Same Chart with Candlesticks.

In essence, the Blue Sky Breakout Strategy is not just a strategy; it’s a mindset. It’s about embracing the endless possibilities of the market, adapting to changing conditions, and seizing opportunities when they arise. Like a skilled sailor navigating uncharted waters, a seasoned trader harnesses the power of the Blue Sky Breakout Strategy to navigate through the highs and lows of the stock market.

So, the next time you find yourself amidst a sea of breakout candles and soaring prices, remember the Blue Sky Breakout Strategy – your compass to navigate the boundless skies of the stock market. As with any strategy, patience, discipline, and a keen understanding of market dynamics are essential. But armed with the knowledge of the Blue Sky Breakout, you’ll be well-equipped to ride the waves of bullish momentum and chart a course toward greater success in your trading journey.

Stock Selection in a Bull Market:

In a bull market, where optimism reigns supreme and prices soar to new heights, selecting the right stocks is paramount. Just as a gardener carefully selects the choicest blooms for a bouquet, a savvy trader must sift through the market’s abundance to identify stocks with the greatest potential for a Blue Sky Breakout Strategy.

Quality Over Quantity:

In the frenzy of a bull market, it’s tempting to chase after every stock that shows a hint of upward momentum. However, seasoned traders know that quality trumps quantity. They focus on stocks with strong fundamentals, robust earnings growth, and solid technical setups. Like a connoisseur selecting the finest wines, they seek out stocks with the potential to outshine the competition.

Sector Analysis:

In a bull market, certain sectors tend to outperform others as investors flock to areas poised for growth. Whether it’s technology, healthcare, or consumer discretionary, each sector has its own dynamics and drivers. Savvy traders keep a keen eye on sector rotation, shifting their focus to where the momentum lies. Like a skilled surfer riding the waves, they align their stock selection with the prevailing currents of market sentiment.

Technical Analysis:

While fundamentals provide a solid foundation, technical analysis offers valuable insights into short-term price movements. Chart patterns, trendlines, and oscillators serve as guideposts, helping traders identify potential breakout candidates. Just as a sailor reads the stars to navigate the seas, a trader interprets price charts to navigate the volatile waters of the stock market.

Risk Management:

In the midst of a bull market euphoria, it’s easy to become complacent and throw caution to the wind. However, prudent risk management is essential to long-term success. Savvy traders set strict stop-loss orders to limit potential losses and preserve capital. Like a captain steering a ship through treacherous waters, they navigate the market with a steady hand, always mindful of the risks that lie ahead.

Patience and Discipline:

Finally, in the fast-paced world of trading, patience and discipline are virtues that cannot be overstated. While it may be tempting to chase after every hot stock, savvy traders know that success comes to those who wait for the right opportunity. Like a master angler patiently waiting for the perfect catch, they bide their time, ready to strike when the conditions are just right.

Conclusion

stock selection in a bull market requires a combination of art and science. By focusing on quality over quantity, conducting thorough sector analysis, employing technical analysis techniques, practicing prudent risk management, and exercising patience and discipline, traders can increase their chances of success in identifying potential Blue Sky Breakout candidates. As with any strategy, diligent research, careful planning, and a dash of intuition are essential ingredients for success in the ever-changing landscape of the stock market.

Once you’ve unlocked the secrets of the Blue Sky Breakout strategy, don’t keep it to yourself. Share this article with fellow traders, friends, and anyone eager to elevate their trading game. By spreading the knowledge, you not only contribute to the collective success of the trading community but also empower others to navigate the bullish markets with confidence and precision. Together, let’s embark on a journey towards greater financial freedom and prosperity.

The insights and strategies discussed in this article are derived from the esteemed work of “Trend Trading for a Living,” authored by Dr. Thomas K. Carr. Dr. Carr’s expertise and extensive experience in trend trading serve as the foundation for the concepts presented here. This article aims to honor his contributions by translating his valuable insights into actionable advice for traders navigating the complexities of the stock market.

Disclaimer

The content provided in this article is for informational purposes only and does not constitute financial advice, investment recommendations, or solicitation to buy or sell any securities. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

The author of this article is not a registered investment advisor and does not hold any certifications or licenses in the financial industry. Any actions taken by readers based on the information presented in this article are at their own risk. Additionally, past performance is not indicative of future results. The Securities and Exchange Board of India (SEBI) regulations require full disclosure of potential conflicts of interest, and readers should be aware that the author may have positions in the securities mentioned in this article.