Introduction – Coiled Spring Strategy

In the dynamic world of stock trading, seasoned traders are constantly looking for trading strategies that offer lucrative opportunities while managing risk effectively.

One such strategy that has gained popularity among traders is the Coiled Spring strategy. Also known as a bull flag or bull pennant setup, this trading strategy capitalizes on the momentum of strong stocks as they consolidate before making their next move.

Imagine a coiled spring—when compressed, it stores potential energy, ready to release with explosive force. Similarly, in the stock market, a strong stock experiences a period of consolidation after a significant uptrend, forming a coiled spring pattern.

This consolidation phase is characterized by a narrowing trading range, akin to the tightening coils of a spring, signaling the stock’s readiness for the next leg up.

Picture a marathon runner taking a brief pause to catch their breath before sprinting towards the finish line. Similarly, a strong stock, after a rapid rise, pauses to consolidate its gains before embarking on the next upward trajectory. Just as the runner’s muscles coil with potential energy during the pause, the stock’s price coils within a narrowing trading range, ready to unleash its momentum

Key Indicators and Parameters:

To identify a Coiled Spring strategy, traders look for specific parameters:

- An up-trending stock that has recently reached a new high, preferably within the past 20 trading days.

- The consolidation phase should exhibit a tightening trading range over the last seven to twenty trading days, forming a triangular pattern.

- Trendlines drawn over the top and bottom of the coiled spring help visualize the pattern, with a break above the upper trendline signaling a buy signal.

In a coiled spring swing trading strategy, you look for a strong stock that recently made a new high. By recent we mean the last in 20 bars. This new high must be at least a new three-month high.

After setting a new high, the stock solidifies in a coiled spring. The coil spring can be short and tight or stretched and discontinuous, but the pattern requires the coil to tighten (trading range decreases) as it moves to the right.

Note that we ignore indicators in this configuration. This is a pure price momentum strategy. All we need are two moving averages, 20 MA and 50 MA, and some trend lines.

Use moving averages to determine whether a stock is in a weak or strong uptrend. The coil spring must last at least seven but not more than 20 bars. It is also important that no part of the coil reaches or exceeds 50 MA. It can exceed 20 MA, but not 50 MA.

Draw trend lines at the top and bottom of the coil spring. It should form a sort of triangular shape due to the narrow trading range of the coil, but it should not be upward-sloping.

Implementation and Buy Signal:

Implementing the Coiled Spring strategy involves monitoring the stock’s movement within the coiled pattern and waiting for a decisive breakout or breakdown.

A break above the upper trendline confirms the bullish bias and triggers a buy signal, while a close below the lower trendline negates the setup.

Traders may also use additional technical indicators such as ADX to confirm the strength of the setup.

Real-Life Application and examples:

Let’s consider a real-life example to illustrate the Coiled Spring strategy in action. Suppose Company X, a leading tech stock, experiences a strong uptrend fueled by positive earnings reports and market sentiment.

After reaching a new high, Company X enters a consolidation phase, forming a coiled spring pattern. Traders who identify this setup patiently await a breakout above the upper trendline before entering a long position, anticipating a continuation of the upward trend.

To deepen our understanding of the Coiled Spring strategy, let’s delve into a few real-life examples that showcase its effectiveness in capturing profitable opportunities in the stock market.

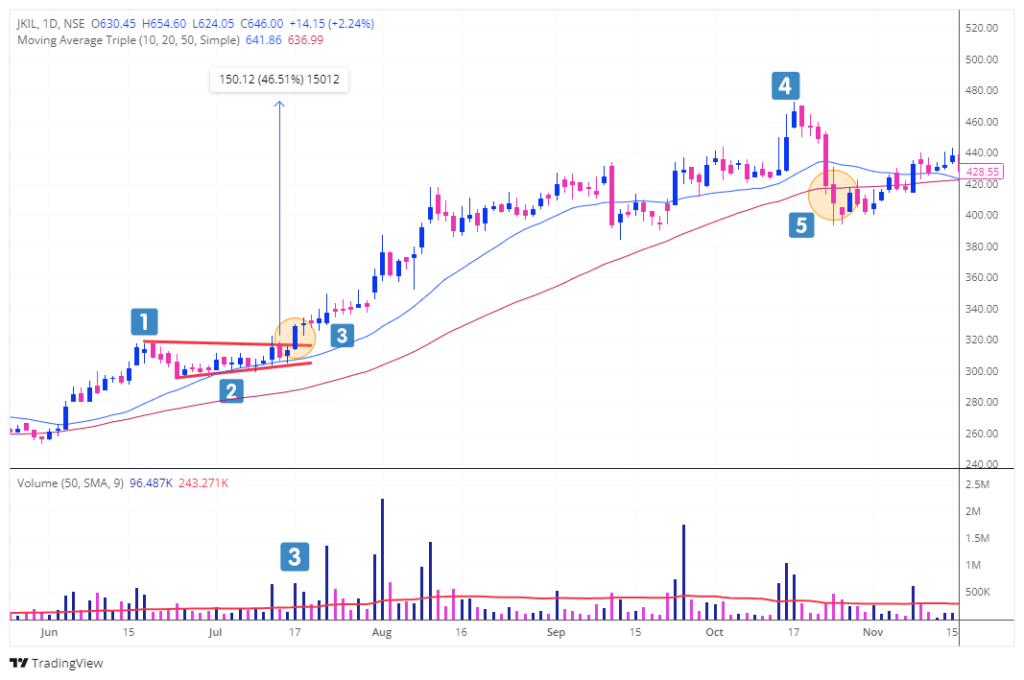

Example 1: JKIL – Leading Infrastructure Stock

- JKIL, a prominent player in the Infrastructure sector, has been experiencing a steady uptrend driven by strong quarterly earnings and favorable market conditions. As the stock climbs to new highs, traders take notice of the formation of a coiled spring pattern during a consolidation phase.

- During this consolidation, the stock’s price oscillates within a tightening trading range, resembling the coiling of a spring. Traders patiently observe the narrowing range and draw trendlines over the top and bottom of the pattern to visualize the setup.

- As the consolidation phase progresses, JKIL stock breaks out above the upper trendline and increases in volume, signaling a bullish continuation. Traders who identified this setup enter long positions, anticipating further upside momentum.

- In the days following the breakout, JKIL stock experienced a surge in buying pressure, validating the Coiled Spring strategy’s effectiveness. Traders who execute timely trades based on the setup capitalize on the upward momentum of price more than +45% before closing below 50 DMA, yielding profitable returns.

- As a Trailing stop, who is using 50 DMA as a stop closed their positions.

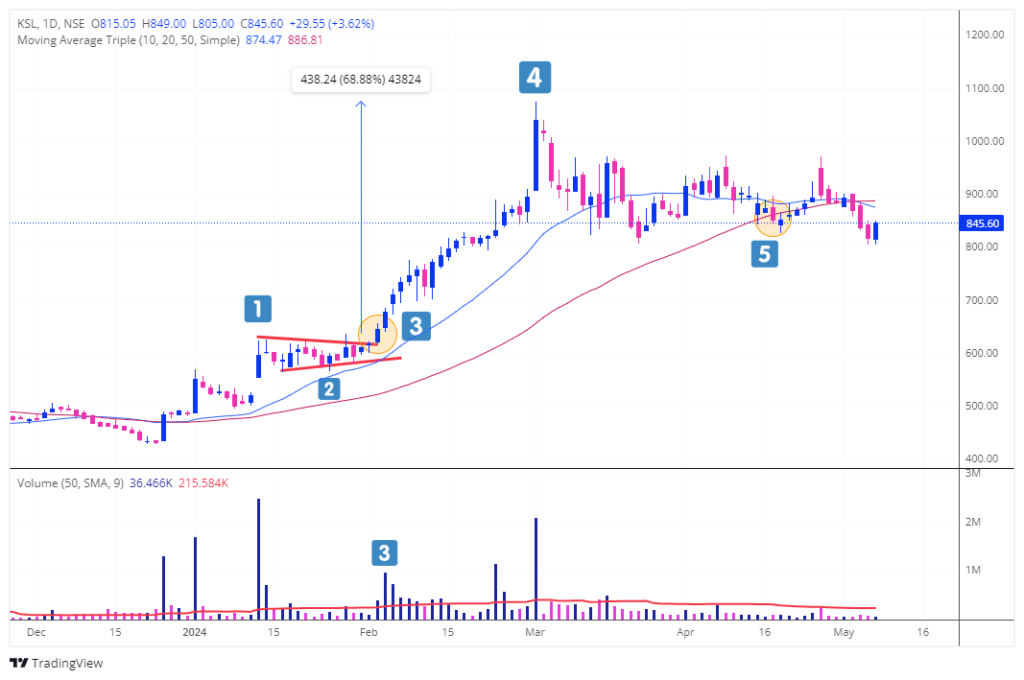

Example 2: KSL – Steel Manufacturer Stock

Another scenario where the Coiled Spring strategy proves valuable is during sector rotation periods in the market.

- KSL made a new high.

- Form a 14-bar coil spring.

- Breaks above Upper Trendline with supportive volumes.

- Made a +65% price move before closing below 50 DMA. (Selling into strength can be used for profit taking)

- Finally, Closed below 50 DMA. (Selling into weakness)

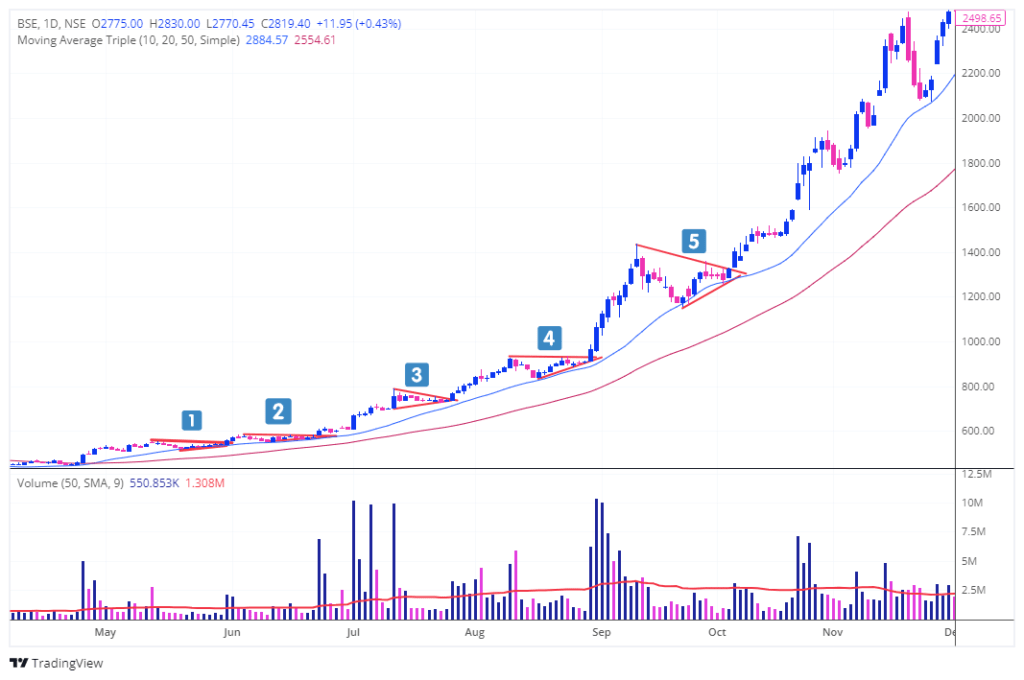

Example 3: IREDA – New IPO Listing

- IREDA – New High after IPO listing.

- Coiled Spring formation of 20 Bars.

- Successful Breakout with volume participation.

- Explosive +95% price move after Breakout.

- Closed below 50 DMA.

Potential Pitfalls and Risk Management:

While the Coiled Spring strategy offers lucrative opportunities, traders must exercise caution and manage risk effectively. False breakouts or breakdowns can occur, leading to losses if not properly anticipated.

Additionally, market volatility and external factors such as economic news or geopolitical events can impact the success of the strategy. It’s essential for traders to set stop-loss orders and adhere to proper risk management techniques to mitigate potential losses.

Here are some potential pitfalls to be mindful of:

- False Breakouts: Occasionally, stocks may experience false breakouts, where they briefly breach the upper trendline before reversing course. Traders must remain vigilant and wait for confirmation before entering trades to avoid being caught in false signals.

- Market Volatility: High levels of market volatility can amplify the risks associated with trading coiled spring patterns. Sudden price fluctuations and erratic market behavior may result in unexpected outcomes, emphasizing the importance of risk management.

- External Factors: Economic news releases, geopolitical events, and other external factors can influence market sentiment and disrupt the effectiveness of technical patterns. Traders should stay informed about relevant developments and adjust their trading strategies accordingly.

To mitigate these risks, traders can employ several risk management techniques, including setting stop-loss orders, diversifying their portfolios, and adhering to predetermined trading plans. By implementing these strategies, traders can navigate the complexities of the market with confidence and resilience.

This strategy, as outlined in Thomas K. Carr’s book “Trend Trading for a Living,” involves identifying stocks exhibiting a coiled spring pattern after a significant uptrend. The book provides insights into the characteristics, key indicators, and implementation of the Coiled Spring strategy, offering actionable guidance for traders seeking to capitalize on momentum-based trading opportunities.

Now that you’ve gained valuable insights into the Coiled Spring strategy and its potential for profitable trading opportunities, it’s time to take action. Share this comprehensive guide with your fellow traders in trading groups and on social media platforms to spread knowledge and empower others to enhance their trading strategies. By sharing this article, you contribute to the collective learning and growth of the trading community.

Additionally, don’t miss out on future articles packed with actionable trading tips, strategies, and market insights. Subscribe to our newsletter to stay updated on the latest trends and developments in the stock market. Join our community of traders dedicated to continuous learning and success. Together, we can navigate the complexities of the market with confidence and achieve our trading goals. Subscribe now and embark on your journey to trading excellence!

Disclaimer:

This blog post is intended for educational purposes only. Any mention of specific stock names or trading instruments is purely for illustration and does not constitute a recommendation to buy or sell. Please be aware that trading & investing in the stock market carries inherent risks, and it is advisable to consult with a qualified financial advisor before making any investment decisions. The information shared here is based on personal learnings, and experiences and may involve risks that could result in financial loss.